Winners and Losers: Sector-by-Sector Breakdown of Last Month’s U.S. Rally

Period covered: September 2025. Benchmark: S&P 500 (SPY). All figures are approximate total returns for the month.

Disclaimer: This is not investment advice.

TL;DR

- Winners: Information Technology, Communication Services, Utilities, Consumer Discretionary

- Middle of the pack: Industrials, Health Care, Financials, Real Estate

- Laggards: Materials, Energy, Consumer Staples

The Scoreboard — 1-Month Sector Returns

| Sector (ETF) | Sep ‘25 Return |

|---|---|

| Information Technology (XLK) | +7.5% |

| Communication Services (XLC) | +6.6% |

| Utilities (XLU) | +4.1% |

| Consumer Discretionary (XLY) | +3.6% |

| Industrials (XLI) | +1.9% |

| Health Care (XLV) | +1.7% |

| Real Estate (XLRE) | +0.5% |

| Financials (XLF) | +0.1% |

| Energy (XLE) | −0.3% |

| Materials (XLB) | −2.4% |

| Consumer Staples (XLP) | −2.5% |

| S&P 500 (SPY) | +3.6% |

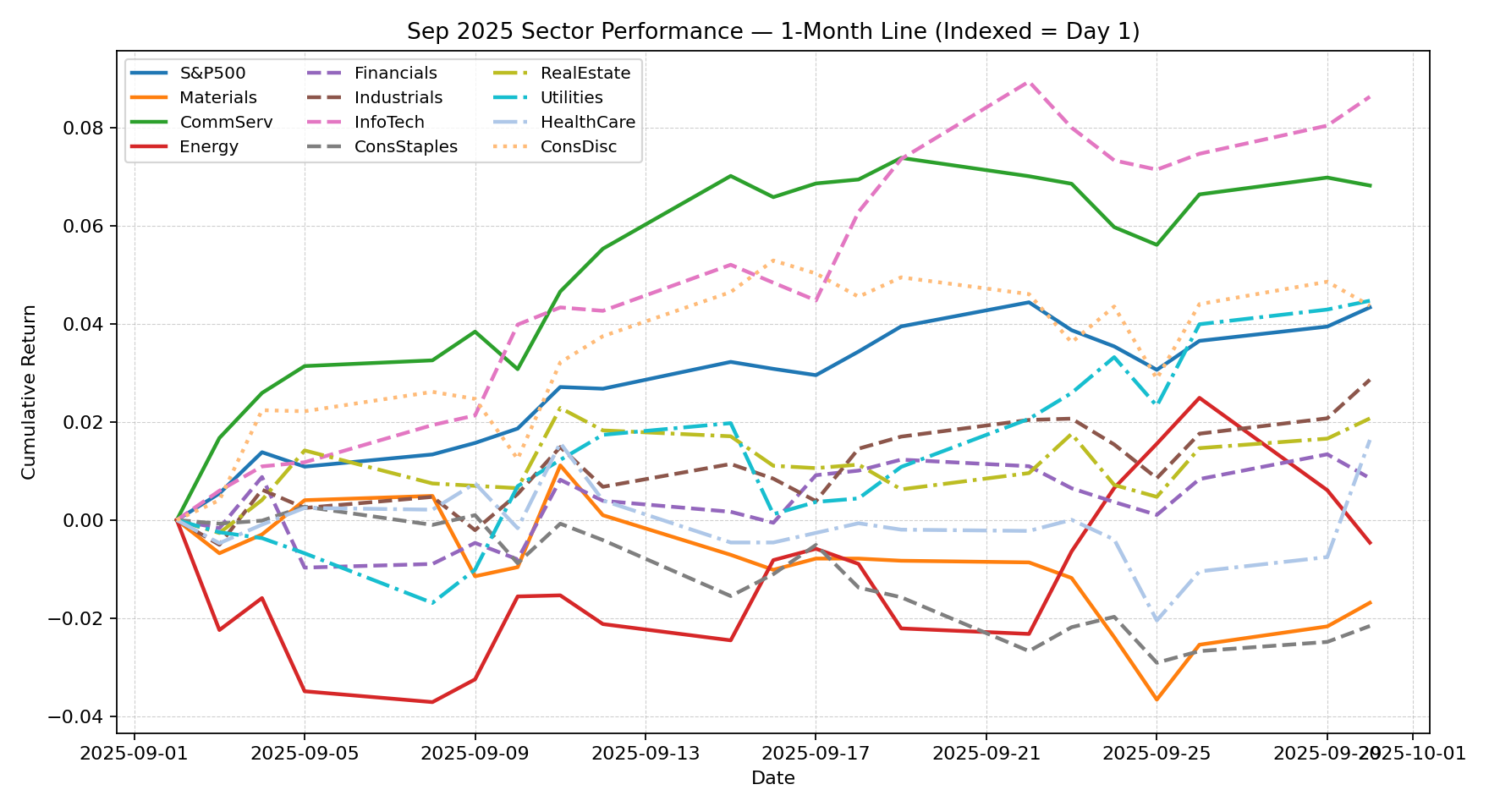

Monthly Line Chart — Sector Performance (Sep 2025)

Sector Drivers — Why Each Group Went Up or Down

- Information Technology (XLK, +7.5%)

Tech stocks were the clear winners. Investors kept buying because of the AI boom and strong demand for semiconductors. Think of it this way: every company wants to build bigger data centers and more powerful computers, and that means tech companies selling chips and software are in high demand. Even though the overall economy had some question marks, the excitement around AI was enough to push this sector higher.

- Communication Services (XLC, +6.6%)

This group includes the big platforms like Google, Meta, and Netflix. The reason they did well is simple: advertising stayed strong, and investors believe AI tools will make these companies even more profitable in the future. Since just a few very large companies dominate this space, their success pulled the whole sector up.

- Utilities (XLU, +4.1%)

Normally, utilities (power and water companies) move slowly. But in September, two things helped them: (1) Investors started expecting interest rate cuts, which makes high-dividend sectors like utilities more attractive. (2) A new story is emerging that AI data centers will need a lot more electricity, which could mean extra demand for utility companies in the future.

- Consumer Discretionary (XLY, +3.6%)

This sector covers things people buy when they have extra money to spend—clothes, cars, online shopping. The rally came because investors were generally in a “risk-on” mood, choosing growth stocks over defensive ones. Plus, companies tied to e-commerce and big events like Amazon’s Prime Day added some extra spark to the sector.

- Industrials (XLI, +1.9%)

These are companies that make machines, airplanes, and infrastructure. They went up a little because the whole market was positive, but they didn’t rally as strongly as tech. Why? Because investors are still cautious about whether global growth will stay strong. If companies cut back on spending, industrial firms would feel it quickly.

- Health Care (XLV, +1.7%)

Health care stocks rose slightly, thanks to some positive news from biotech and pharmaceutical companies—like good clinical trial results. But overall, health care wasn’t the center of excitement. Investors saw it more as a “steady and defensive” sector, not a growth engine like technology.

- Financials (XLF, +0.1%)

Banks and financial firms barely moved. On one hand, hopes of lower interest rates helped because it reduces the pressure on borrowers. On the other hand, banks earn money from the difference between what they pay depositors and what they charge borrowers (net interest margin). If rates fall too much, that margin shrinks. That tug-of-war left the sector mostly flat.

- Real Estate (XLRE, +0.5%)

Real estate companies (mostly REITs) depend heavily on interest rates, since they borrow a lot. When investors thought rate cuts were coming, the sector got a small lift. But high borrowing costs and fewer property transactions meant the rally was very limited.

- Energy (XLE, −0.3%)

Oil and gas companies lost a little ground. At the end of the month, oil prices slipped, which directly hits their revenue. There was also some noise around mergers and acquisitions that made investors hesitant to pile in.

- Materials (XLB, −2.4%)

This sector includes miners and chemical makers. It struggled because commodity prices softened and demand from countries like China looked weaker. When global growth slows, these companies usually feel it first, since their products are the “raw ingredients” for many industries.

- Consumer Staples (XLP, −2.5%)

These are companies selling everyday goods like food, drinks, and household items. They fell because investors preferred to put their money into riskier, faster-growing stocks. Staples are considered “safe but boring,” so in a rally led by tech and growth stocks, they were left behind. Rising costs for raw materials also hurt their margins.

Key Takeaways for Investors

- Concentration risk is high. Tech and Communication Services carried the rally. If they stumble, the S&P 500 will too.

- Rates drive rotation. Lower rate expectations helped Utilities and REITs, while hurting Staples.

- Growth vs. safety balance. Investors favored risk-on plays, leaving defensives behind.

- Earnings season ahead. Whether the rally broadens or narrows will depend on company guidance in Q3.

Comments (0)

No comments yet. Be the first to comment!